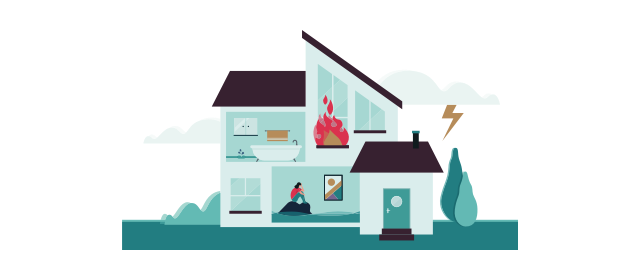

Why choose Allianz Harmony Certified Consumer Friendly Home insurance?

Base package |

Supplementary coverages |

|

Elemental damage |

Basic risks |

|

Coverages of Allianz Harmony Certified Consumer Friendly Home insurance

Supplementary coverages

Allianz Harmony Certified Consumer Friendly Home Insurance – with a quick and easy process to report claims

Would you like to report a claim or request information on a claim settlement in progress?

FAQ – Frequently asked questions

Building insurance – Permanently inhabited detached houses, semi-detached houses, terraced houses, flats can be insured and structures not indicated separately in the policy (e.g. pavement, fence, gate, car park). Outbuildings, like garage, barn, pigsty or storage building can be insured together with the main building. Insurance for the building covers, among other things, solar panels, solar collectors and heat pumps.

Movables – Household movables can be insured (household equipment, appliances, television, computer and other telecommunication equipment, clothes, furniture, books, instruments, kitchen appliances etc.)

Base package cover value-preserving assets up to 200 000 HUF. Values above this covered in the Valuables supplementary insurance.

Considered as valuables:

In addition to the Base Package, you can choose from both personal insurances and supplementary insurances.

Personal insurance - accident insurance, family life insurance

Valuables - cash or valuables supplementary insurance

Other assets - special glass, theft of building accessories, graffiti, garden furniture, garden ornamentals, live plant cultures supplementary insurance, and unblocking of drains.

Family life insurance and accident insurance are available as supplementary insurances. Life insurance covers the person who named in the insurance policy as an insured person, as well as his or her spouse living with him or her in the place of risk of the property insurance and his or her close relative living in the same household up to the age of 85. Accident insurance policyholders are the same as property insurance policyholders.

The insured person under the property insurance will be a person who has the interest of securing the property and

a) who is

• an owner and co-owner(s)

• a tenant and co-tenant(s)

• a beneficiary

of the real property specified in the policy by the policyholder with a full address (land register reference number)

b) who is a relative permanently living in the same household with the insured person indicated in section a) in the place of risk coverage,

c) in the event that the insured person indicated in section a) does not permanently live in the place of risk coverage but a close relative does then such close relative will also be qualified as an insured person.

Please visit the webpage of Hungarian National Bank and take a look at the comparison page of Certified Consumer Friendly Home insurances!

Do you need help?

Find documents relevant for you